Continue being tranquil. If you get a interaction that triggers a robust emotional reaction, have a deep breath. Speak with someone you have confidence in.

The company has also up to date its identification verification approach to answer rising threats, it mentioned, and strategies further more updates.

Various news retailers that focus on cybersecurity have looked at portions of the info Felice offered and mentioned they look like genuine people’s real details. If the leaked material is exactly what it’s claimed to become, Below are a few on the challenges posed along with the ways you normally takes to shield yourself.

True Random Generator does not use the standard pseudo-random algorithm all pcs use. It generates an output for the net person. This can be a correct-random worth. Also, This is certainly better than the random benefit that a conventional computer generates.

A sole proprietor and officers of an organization and professionals of the LLC is often held personally accountable for non-payment from the profits tax and social security taxes whether basically collected from the employee.[121]

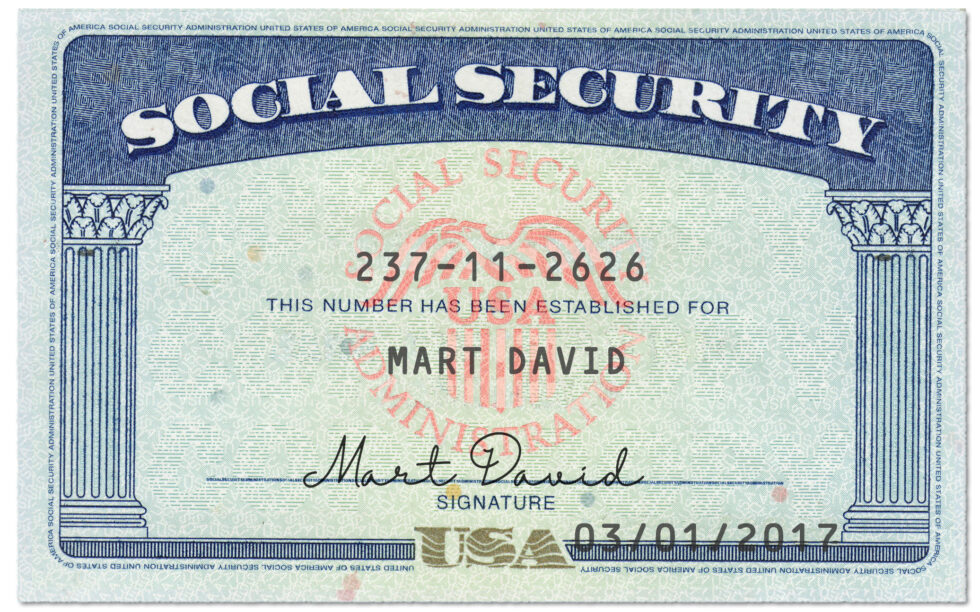

A credit rating copyright is actually a Device that can generate copyright history card having a title, expiration day and figures, just like a serious card. These quantities are randomly generated and aren't connected to an actual account. They can be utilized for development or tests applications.

These graphs vividly exhibit that generalizations about Social Security Positive aspects could possibly be of tiny predictive benefit for any presented worker, as a result of extensive disparity of net Rewards for individuals at distinctive earnings stages and in several demographic groups. By way of example, the graph underneath (Determine 168) demonstrates the affect of wage degree and retirement day on the male employee. As earnings goes up, net Gains get scaled-down – even negative.

1996 Drug dependancy or alcoholism incapacity benefits could not be qualified for incapacity Advantages. The Earnings Restrict doubled the exemption sum for retired Social Security beneficiaries. Terminated SSI eligibility for some non-citizens

Proposals to reform with the Social Security program have triggered heated debate, centering on funding of the program. In particular, proposals to privatize funding have induced wonderful controversy.

There’s an option to pick the point out, which can be remaining vacant for randomizing the state, far too, and There is certainly an alternative choice to enter the volume of SSNs the consumer really wants to generate, which may go up to fifty at most.

Our employees won't ever threaten you for info or assure a gain in Trade for personal information or money.

A employee who claims the retirement profit ahead of the whole retirement age gets a decreased month-to-month advantage amount and also a employee who promises at an age after the entire retirement age (around age 70) gets a heightened month to month total.[38]

The worker must be not able to carry on in his / her click here past occupation and struggling to regulate to other perform, with age, education and learning, and operate working experience taken into account; Moreover, the incapacity have to be prolonged-term, Long lasting twelve months, anticipated to very last twelve months, resulting in Demise, or expected to result in Demise.

Originally the benefits received by retirees weren't taxed as money. Commencing in tax yr 1984, With all the website Reagan-period reforms to repair service the system's projected insolvency, retirees with incomes around $25,000 (in the case of married persons filing individually who didn't Are living with the wife or husband Anytime throughout the 12 months, and for individuals submitting as "solitary"), or with mixed incomes about $32,000 (if married filing jointly) or, in certain instances, any profits amount of money (if married submitting separately from your husband or wife in a very calendar year during which the taxpayer lived Together with the husband or wife at any time) normally noticed A part of the retiree Gains subject to federal revenue tax.